The Fundabl Ecosystem

Secure Initial Funding, Build Strong Business Credit, and Become Bankable — All in 3 Steps with Fundabl

GOAL #1

Initial Funding

Start with our A.I. Business Scan to instantly see if you pre-qualify for 20+ funding programs and 200+ direct lenders. View your best options, apply with one click, and move seamlessly into automated document collection for fast funding.

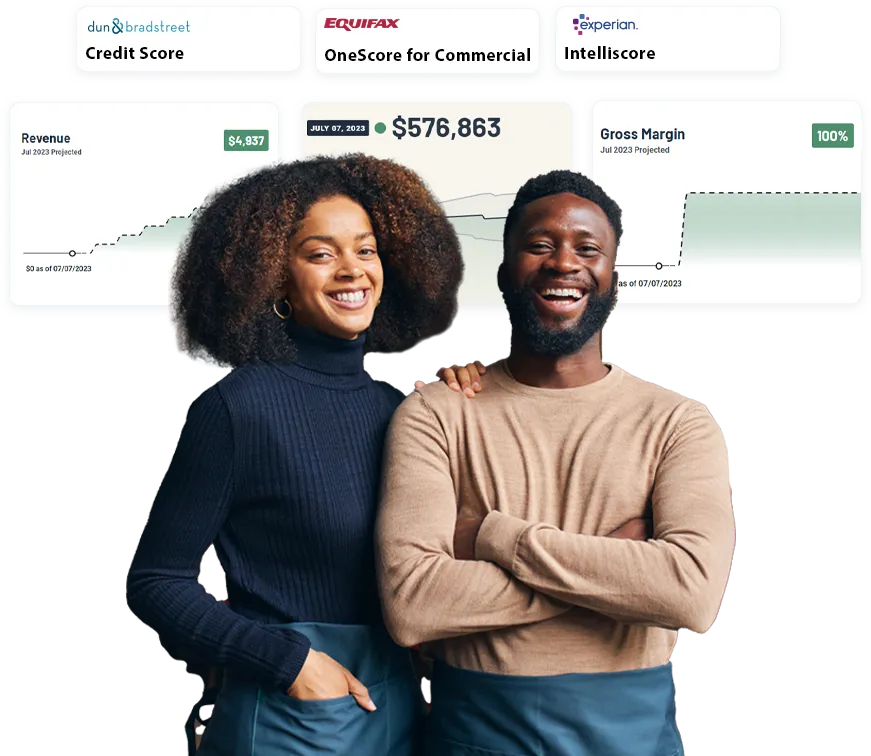

GOAL #2

Build Strong Business

Credit & Become Bankable

Next, we help you build strong business credit and raise your FICO® SBSS—the score banks rely on for approvals. You’ll unlock access to 3,000+ vendor credit lines, high-limit cards, fleet cards, store accounts, and even computer or vehicle leases with no personal guarantee. With exclusive starter and advanced vendors, your business gains the buying power, credibility, and leverage to grow on its own terms.

GOAL #3

Bankable Funding

Finally, join the 1%. Bankable businesses unlock loans up to $5M, 20-year terms, and interest rates as low as 12–15%. Most never reach this level because they don’t know how—but we guide you step-by-step. In as little as four months, you can shift from costly short-term funding to long-term, affordable financing that puts banks and lenders competing for your business.

What Sets Us Apart

Best Funding For Your Business

Our clients get matched with the best possible funding across the entire funding marketplace.

No Credit Impact to Pre-Qualify

We provide a free pre-approval estimate with no negative impact to your credit

Proven Process

Step-by-step system to help your business build strong business credit and become bankable.

Become Bankable

The process of a small business "Becoming Bankable" is not difficult, but it is complicated. The issue is that ninety nine percent (99%) of small business owners simply do not know what is involved. Our system guides you step-by-step through the process of Becoming Bankable.

The Most Affordable Corporate Credit Building Program on the Market

NOW we have made it AFFORDABLE to get Fundabl! We invite companies of ALL sizes to join, including start-ups looking to build a new credit profile and established businesses looking to strengthen their credit scores in the least amount of time possible.

Trusted by Thousands of Business Owners and Entrepreneurs

"Fundabl completely transformed how we access capital. We secured $125,000 in funding and improved our business credit profile in just months. The process was smooth and far easier than any bank we’ve dealt with."

"The funding strategies at Fundabl are incredible. We were approved for $200,000 in growth capital and built the foundation for ongoing business credit lines. This saved us countless hours and positioned us for long-term success."

"The insights from Fundabl gave us access to $80,000 in revolving credit lines and boosted our approval odds dramatically. Our cash flow is stronger, and our team is finally able to focus on growth."

"The Fundabl support team is amazing! They helped me organize my financials and I was approved for $150,000 in SBA funding. My business has doubled since working with them."

"I love how Fundabl integrates everything—funding, business credit, and advisory support. We secured $90,000 in capital and gained access to credit lines that keep our business moving forward."

"As a small business owner, I was skeptical about funding programs. Fundabl proved me wrong—we secured $60,000 in working capital and started building our credit profile. Every dollar has been worth it."

MEET THE FOUNDER & CEO

Hey, I'm Name!

I started lorem ipsum dolor sit amet, consectetur adipisicing elit and have since been able to lorem ipsum.

Ever since I've been able to lorem ipsum dolor sit amet, consectetur, including some cool stuff like:

Credibility factor lorem ipsum

Authority stats and other lorem ipsum

Results and experience lorem ipsum